.webp?width=2917&height=1250&name=How%20Zelle%20Works%20(1).webp)

Whether it's shopping, job interviews, education, or payments, more and more people are making the switch to the virtual sphere. And it makes sense - doing things digitally is not only cost-effective but also faster. For instance, these instant payment services; when it comes to paying, why bother with cash when you can just click a few buttons and be done?

These digital platforms have not only changed how we shop, save, and send money, but they've also made banking more convenient, speedy, and flexible. P2P payment apps like Zelle, for example, allow users to send or receive money quickly and for free, all within a few minutes. But despite not charging any fees, many wonder how Zelle makes money. This article will explore Zelle's business model, how it works, and how it generates its revenue. So, let’s start with its quick introduction.

Zelle App: Company History

Back in 2011, some heavyweights in the banking world - Bank of America, JP Morgan Chase, and Wells Fargo - came together to create what we now know as Zelle. Initially called ClearXchange, the idea was to offer an alternative to popular payment apps like Venmo and PayPal. However, when it first launched, users weren't too impressed due to its sluggish performance and poor user interface.

Then in 2016, a major shift occurred when the banks decided to hand over ClearXchange to Early Warning, another consortium of banks. Early Warning took charge of revamping the app, giving it a much-needed makeover. This marked the birth of Zelle as we know it today.

As a result, the app quickly attracted 100 million users, making it widely adopted in the retail payment app market. Moreover, Early Warning went all out with its marketing efforts, splurging $1 million on a single TV ad to promote the app. To make Zelle easier to use for everyone, Early Warning standardized its features and look across all banks. In its early days, the app saw significant growth among both younger and older users.

Zelle: The Rise of a P2P Payment Giant

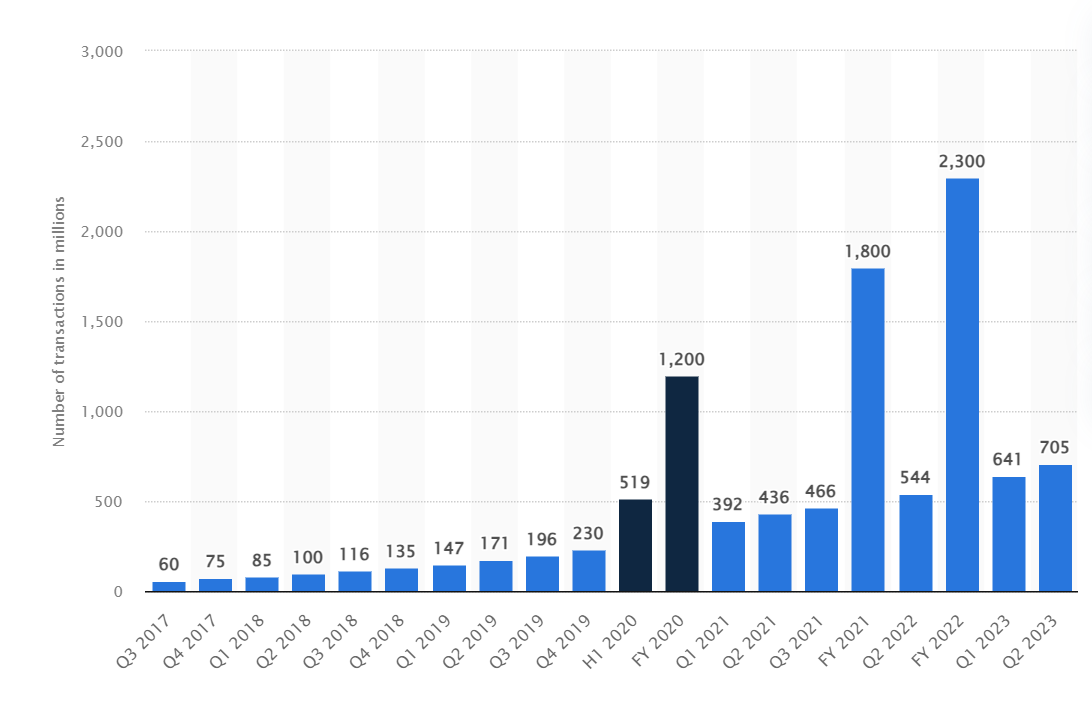

In 2017, Zelle officially launched its platform, partnering with 30 banks and processing over $75 billion in transfer volume during its first year. Now, they've expanded their network to include over 1800 financial institutions of all sizes, allowing more than 90% of the US population to use Zelle through their banking apps for easy money transfers.

Even though Venmo had more name recognition and user base initially, Zelle's close ties with the banking sector enabled it to offer faster, more cost-effective, and seamless payment services. Within just two years of its launch, Zelle became the preferred option for peer-to-peer payments, surpassing competitors like Venmo and Paypal.

Now, in 2024, Zelle has facilitated over 5 billion transactions, amounting to roughly $1.5 trillion(Yes, a Trillion!). While the number of transactions increased by 26% year-over-year, the total transaction value grew by 28% year-over-year. Notably, their user base is expected to grow by 8% in 2024, reaching 73.2 million users.

Zelle: The Business Model Explained

Zelle® is a quick and safe digital payment platform designed for individuals and small businesses in the US to easily send and receive money. The company operates from different locations like Chicago, San Francisco, and Scottsdale.

Users of the Zelle app can swiftly transfer funds from their bank accounts to others on the platform without dealing with wire transfers or pesky transaction fees. However, only folks in the US with bank accounts linked to the Zelle network can use this e-wallet app. Once signed up, users can start making transactions online using either a phone number or email address, much like how PayPal works. Transactions happen in a flash, with funds appearing in the recipient's account within a few minutes.

Zelle runs on the payment rails provided by MasterCard Send and Visa Direct.

Despite PayPal and Venmo being popular e-wallet apps, Zelle gained traction for its speedy and secure payment services. Its success has led to a surge in demand for e-wallet app development today.

Yet, many business owners are left wondering: How does Zelle actually make money? If you're curious too, let's dive into the answer in the next section.

Zelle: How Does it Make Money?

Now that we've covered the business model, let's see how Zelle makes profits.

Though Zelle has boasted of processing more than $1 trillion until now, they don’t directly generate revenue. Since the digital platform is completely free and does not charge a fee, it has become the popular choice for financial institutions as this allows them to keep their transaction fees much lower than other third-party digital payment platforms. Many business analysts believe that it may levy transaction volume fees on its partner banks based on the volume of payments processed through the network.

Unlike other similar services like Venmo or CashApp, which charge banks fees for each transaction, Zelle keeps these transactions within the banking system, which ultimately reduces expenses for banks. This approach allows banks to benefit from the growing trend of cashless transactions while cutting down on the need for physical branches and ATMs.

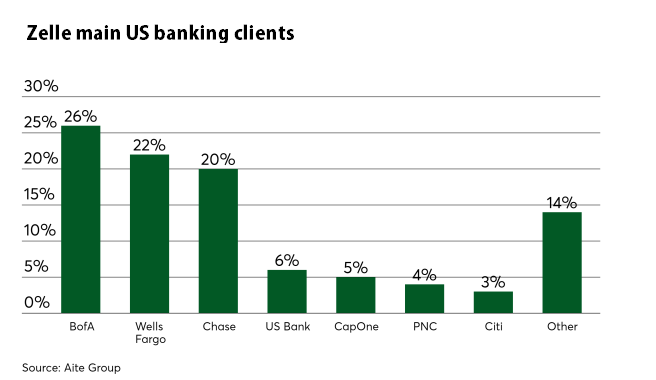

Furthermore, Zelle indirectly brings in revenue for a group of banks that collectively serve about 100 million customers in the USA. This revenue comes from various additional services offered through the app, such as loans, insurance, mortgages, and credit cards. Despite being relatively new, Zelle has quickly become the largest peer-to-peer payment service in the USA, with users completing billions of dollars in transactions.

Zelle also earns money from participating banks to ensure the network's security and reliability. Additionally, in 2018, Zelle introduced a feature allowing users to make payments to businesses for goods and services.

While consumers can use Zelle for free, merchants are charged a 1% fee by Mastercard or Visa, and a portion of this fee is shared with the banks that issued the cards. Zelle also promotes other financial products within its app, allowing partner banks to earn money through referrals and commissions.

Want to Build a Zelle-like App?

So, that wraps up our overview of the Zelle p2p payment app and its business model & revenue streams. It's visible enough that Zelle will have a big effect on how we send money online in the future.

A recent report predicts that by 2030, the global P2P payment market will reach $9.87 trillion. This big jump is because more people are using online and mobile banking. And as technology gets better, using such payment platforms will only get easier and more reliable.

If you're considering developing your own digital payment app similar to Zelle, Daffodil is here to assist you. As a leading mobile app development company with over two decades of experience, we have the expertise and capabilities to bring your vision to life.