Aspiring entrepreneurs from third-world countries and underprivileged communities often find it impossible to fund their dreams by applying for loans. This is because of their lack of credit history or sometimes even little to no access to formal financiers. However, fortunately, microlending apps such as Kiva are here to change the state of small businesses in dire need of funding. But how does the US-based online microfinance company Kiva really work?

Companies such as Kiva delivering personal microloans provide representation and much-needed capital to underserved entrepreneurs through highly intuitive mobile applications. They help enrich the struggling, yet resilient small business economy that applies a personal touch to products and services rendered.

In this article, we will discuss specifically how Kiva works, how it funds the loans offered, and also the overall impact that the small businesses sector has seen from it. But first, let us define what microlending or microfinance is.

What Is Microfinance?

Microfinance, microlending, or microcredit are interchangeably used to refer to the same thing - extending loans of small amounts to people without standard credit history or a means to apply for a loan. Micro lending apps that serve as platforms to link borrowers with interested crowd-funders and investors leverage peer-to-peer (P2P) networks to facilitate financial exchanges. These financial exchanges essentially function outside rigid and conventional financial systems but adhere to local monetary laws.

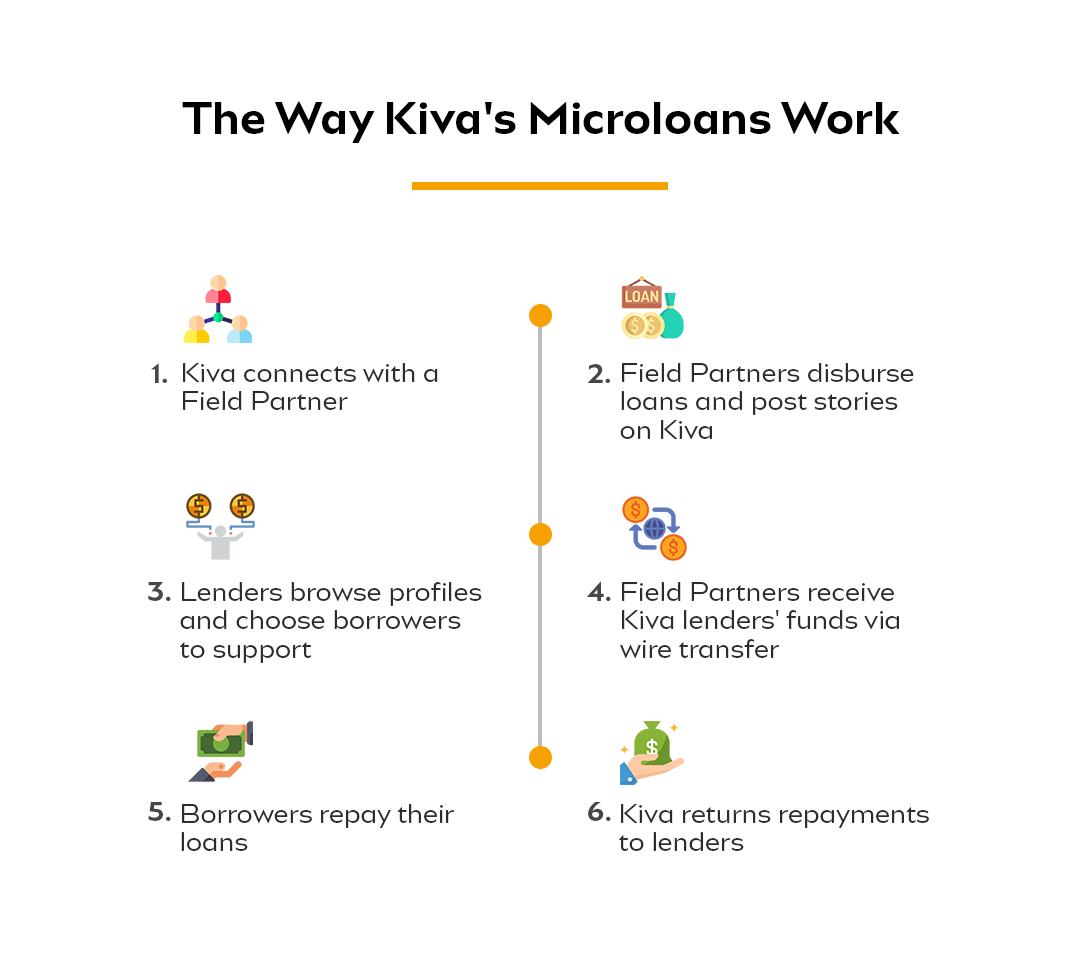

The Kiva Microloan Lifecycle

Kiva is an over 100-employee nonprofit, based in Silicon Valley and its loans are not made out directly to borrowers who post their requests with the Kiva app. Kiva forms a partnership with investors or other reliable entities who have philanthropic objectives that are in congruence with its own. These lenders must have a proven track record in serving the underprivileged before they can apply to join the micro-lending platform.

The forming of this valuable connection, done through a mediator, makes up a lifecycle that is defined in the following steps:

1)Connecting With Field Partner

Kiva connects with organizations that specialize in finding philanthropic lenders and match them with goal-oriented borrowers. These organizations are referred to as Field Partners who work at a local level and facilitate loans for communities that are in dire need of funding. Schools, microfinance institutions, NGOs, social workers organizations, are all examples of Field Partners that Kiva connects with.

2)Loan Disbursal And Online Engagement

Depending on the borrower's request on the Kiva app, the Field Partners disburse loans directly to them on behalf of Kiva. Most of the loans are disbursed as the borrowers reach Kiva before the requests are posted on the app. So borrowers do not have to wait for investors and crowd funders to fund their loan on the app to actually receive the money. Field Partners then post stories describing the borrower's journey and edit them before publishing on social media.

Customer Success Story: Digital Transformation of UAE’s Largest Bank through a customized Document Management System

3)Interested Lenders Choose Which Borrowers To Fund

Anyone with a phone and an internet connection can register on the Kiva app as a lender by offering to fund a loan with as little as $25. This helps underserved individuals grow their small businesses, afford to pay bills, education fees, switch to a better life, and much more. This sort of crowdfunding then backfills the loans that have already been disbursed by the Field Partners. Lenders take on the risk for the borrowers' loans that they support.

4)Wire Transfer To Field Partners

Lenders' funds are transferred to Field Partners as capital at 0% interest, which helps backfill loans that have been disbursed to the rightful borrowers. Through this arrangement, Field Partner organizations are enabled to scale up their efforts to help marginalized communities to prosper and find a better quality of life.

5)Loan Repayment

Field Partners then collect the loan repayments from past borrowers and also often charge interest to cover the operating expenses. Non-profit organizations make up more than 60% of the Field Partners that only charge a minuscule interest charge to cover their overhead. No interest is provided by Kiva to its lenders and it does not charge interest to its boarded Field Partners.

6)Billing And Return To Lenders

Kiva uses an efficient billing system that allows it to drastically reduce the expense of wire transfers. The amount of Field Partner repayments is subtracted from the sum loaned out by Kiva lenders at the end of every month. The partners then wire-transfer the difference to Kiva. The lender can withdraw the repayments into a PayPal account or donate them so that Kiva can make a massive impact on the small business economy.

How Does Kiva Innovate To Make Its Borrowers’ Lives Better?

Kiva has continued to innovate to find new ways to make an increased impact in the lives of its borrowers who are from remote areas. The primary way this is happening is through the optimal matching of borrowers' repayment schedules with the economics of the local community of businesses.

Let us take the example of farmers who may apply for a microloan to buy better seeds and fertilizer to boost yields. Repayment models under traditionally weekly plans would make funding prohibitive for a farmer and would ultimately add to their burdens. Instead, Kiva offers a grace period allowing the farmer to repay the loan when the harvest actually increases from the new seed and fertilizers bought with the loaned amount.

Kiva's Operational Costs

Only about 10% of the total amount of money disbursed as microloans to Kiva's borrowers is outstanding at this point in time. Meanwhile, most of the loans have already been repaid to lenders or are in the process of being wire-transferred by borrowers. Many of these lenders even reinvest the money repaid by Kiva. All this is made possible because of a robust revenue model.

Kiva funds its operating costs primarily from tips that it receives every time a loan repayment is completed. This is a borderline-philanthropic approach that even some of Kiva's Field Partner organizations would envy. Every time a lender on the app successfully funds a loan, they are asked whether they would like to offer an optional tip.

The operational cost of each loan is $3.75, which is justified under Section 501(c) of the US Internal Revenue Code (IRC). While 60% of Kiva's operational costs are covered by tips, donations, corporate partnerships, and grants help pay for the rest.

ALSO READ: How does Venmo Work? Business Model and Revenue Streams

Kiva's Impact And Why There Need To Be More Microfinance Apps

A total of $1.6 billion in microloans have been disbursed by Kiva since its inception in 2005. The Kiva app has helped 3.9 million people, 81% of whom are women, to secure microloans without a traditional credit history. Several borrowers from farming communities, war-torn conflict zones, as well as the least developed countries have been supported by lenders signing up on Kiva.

More such technological initiatives are developing every day, but not enough of them are able to make a difference. Kiva was a success because of its hands-on mobile application that is easy to understand and intuitive for the not so tech-savvy. If you are looking for such robust, yet simple mobile solutions for your business, you can set up a free consultation with Daffodil Software today.